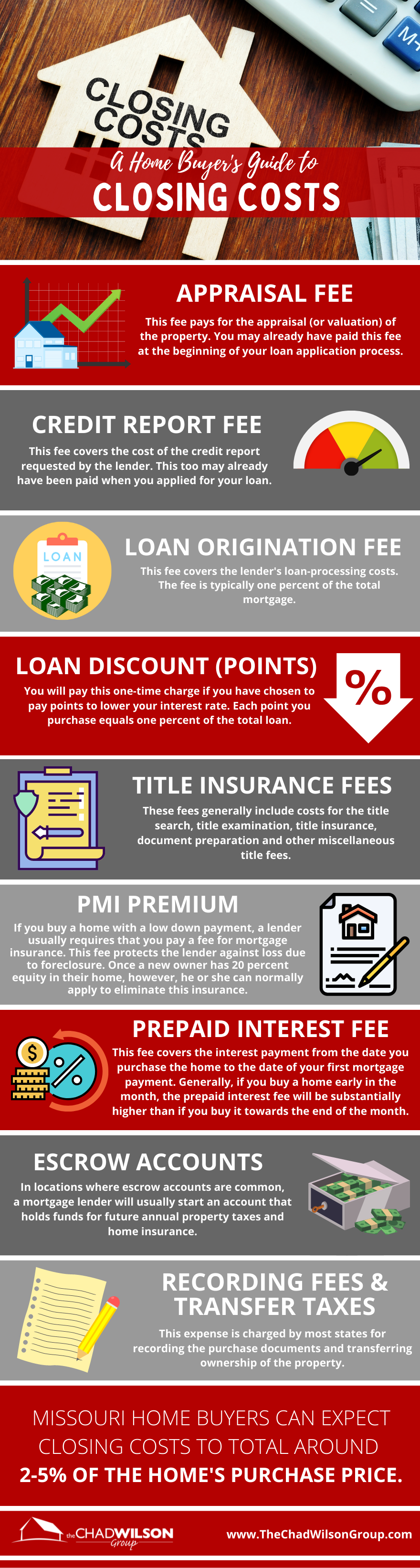

This couple bought a rundown abandoned house for $1.5 million and plan to make it their forever home: Take a look inside Published Sat, Apr 20 2024 12:00 PM EDT Updated Sun, Apr 21 2024 3:22 PM.. Costs you may have to pay. Property appraisal. $300-$500. Usually your mortgage provider will ask you to have the property you’re purchasing appraised at your expense. The cost will be higher for large, unique or rural properties. Property survey. $1,000-$2,000. Your mortgage provider may want an up-to-date survey.

GMAR Open House Newsletter

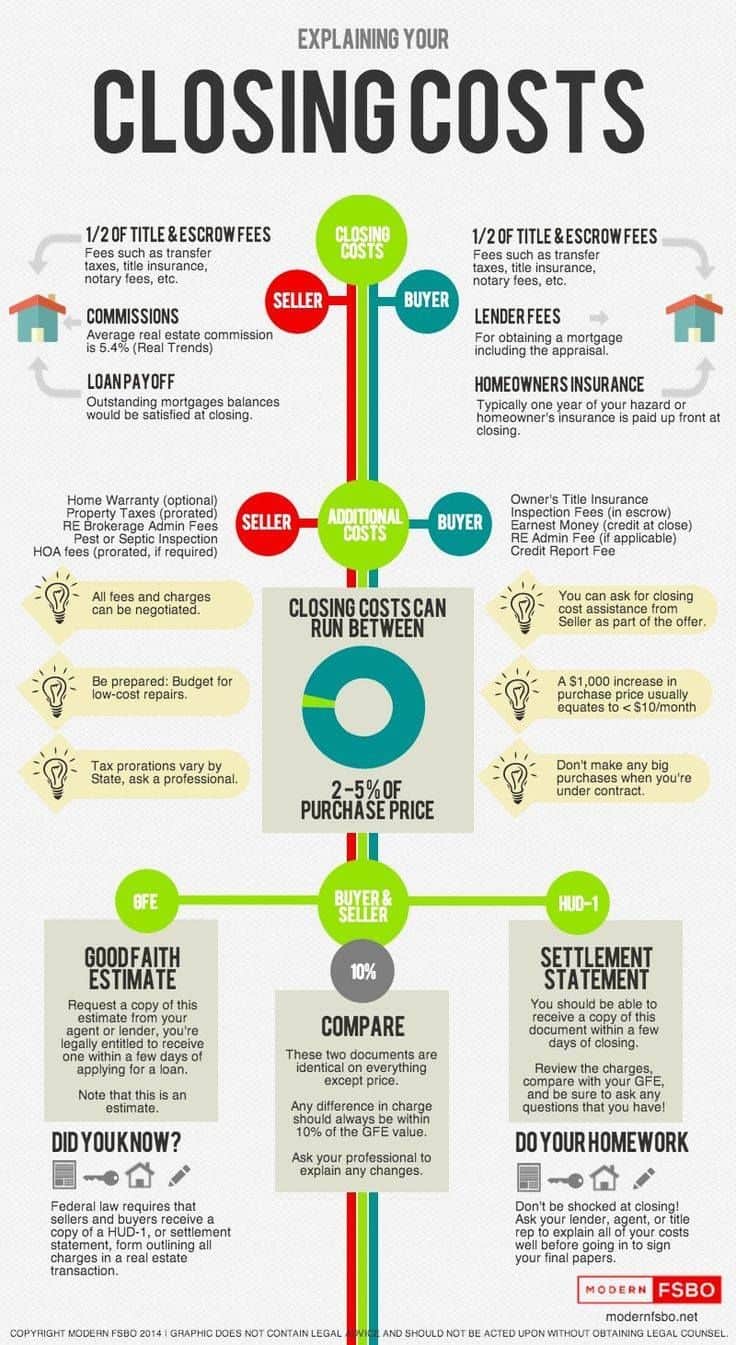

Everything You Need to Know About Closing Costs

Typical Selling Costs You Should Prepare for When Selling a House

Closing costs can add considerably to the price of buying a house The Washington Post

Pin on Building a dream home

What You Should Know About Closing Costs

Understandijng your closing costs. Buyer vs. Seller Who pays for what? Real estate tips, Home

Closing Costs for a New Home Closing costs, Home buying process, Buying your first home

How to Get the Seller to Pay for Closing Costs

Factoring closing costs into the budget for your new home will help provide a realistic pict

10 Steps to Closing on a House [Infographic] Home buying process, Buying first home, Home

How To Avoid Closing Costs When Buying A House FortuneBuilders

Home Loans 101 What are Closing Costs?

How Much Is Closing Costs On A House? The Housing Forum

10 Closing Costs in Alberta When Buying or Selling Your House

Why Are Closing Costs So High? Everything Home Buyers Need to Know Budget and the Bees

Buying a Home? A Guide to Closing Costs in Canada

What Is Included In Closing Costs For Buyer BAHIA HAHA

A Home Buyer’s Guide to Closing Costs [INFOGRAPHIC]

More Than Half of All Buyers Are Surprised by Closing Costs Sherwood Strickland Group

Closing costs on a $100,000 mortgage might be $5,000 (5%), but on a $500,000 mortgage they’d likely be closer to $10,000 (2%). In addition, mortgage closing costs are often a smaller percentage.. On average, closing costs in the province of Alberta range from 3% to 5% of the total property value. Here’s an example: If you purchased a home in Alberta for $500,000, you could expect to pay between $16,600 (3% of the property value) to $25,000 (5% of the property value) in closing costs. Considering that property values are on the rise in.