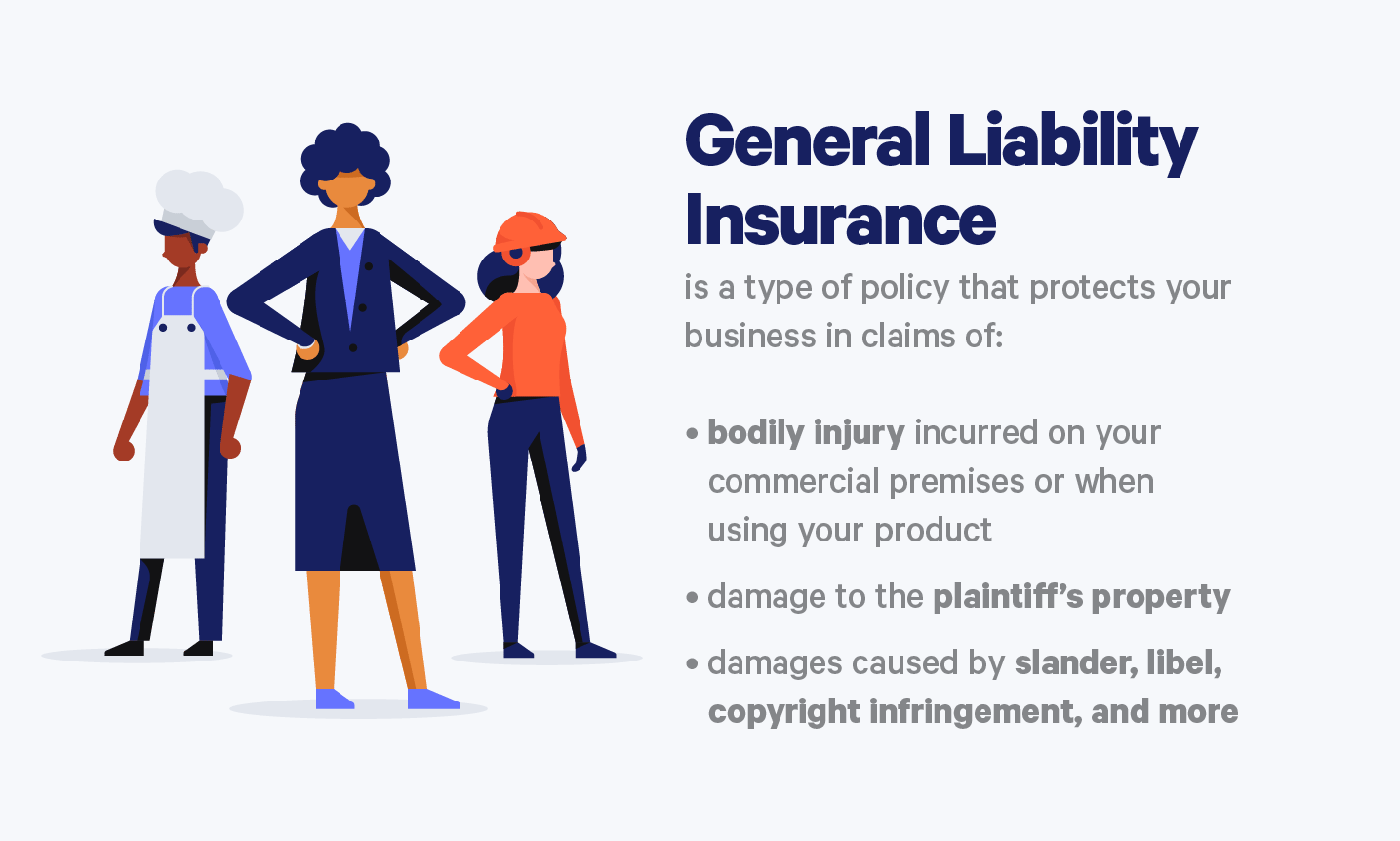

Public Liability covers you in cases where your business causes damage to property or injury to third parties, and you are liable for the related costs. Professional Indemnity, on the other hand, protects you when an incident happens due to the professional recommendation to your clients. A lot of businesses benefit from having both covers.. Professional indemnity insurance and public liability insurance are two distinct types of legal coverage, each serving different purposes. The difference between public liability and indemnity insurance is: Professional Indemnity Insurance: Is designed to protect professionals, such as consultants, from claims of negligence or professional.

Professional lndemnity lnsurance Smart Sure

What does Public Liability Insurance means Dubai Online Insurance

How much does Professional Indemnity Insurance cost?

What is professional indemnity insurance

Professional indemnity insurance What is it and how does it work? Insurance Business America

The Difference Between Professional Indemnity and Public Liability YouTube

Do Businesses Need Insurance? The Lowdown Checkatrade

What Is Professional Indemnity Insurance? upcover Blog

General Liability vs. Professional Liability Insurance Coverage Embroker

Professional Liability Insurance Explained Insurance Training Center

Professional Indemnity Insurance YouTube

Professional Indemnity & Public Liability Insurance Manchester

What is the difference between professional indemnity insurance and public liability insurance?

.png)

Professional Indemnity Insurance

Professional Liability Insurance For Small Businesses Secondary Insurance

Public Liability & Professional Indemnity Insurance Difference

5 What is the difference between professional indemnity vs public liability insurance YouTube

Professional Indemnity Insurance How Much Does it Cost?

Professional Indemnity Insurance vs. Public Liability Insurance

Understanding the Need for Professional Indemnity Insurance WorthvieW

Professional indemnity insurance will pay out to cover the following costs of a claim: Your legal defence – the costs of defending you in court against claims of malpractice or professional negligence. Compensation – any sum awarded to cover the cost of rectification of faulty work or any additional compensation awarded by the court.. Public Liability Insurance: This policy would protect you from the legal fees and damages awarded to your injured client. Some public liability policies will also have Food & Beverage extensions, which will cover food poisoning caused by your business. Professional Indemnity Insurance: This policy would protect you from the legal fees and.